Purchasing a property is most likely the biggest financial decision you will ever make. Whether this is your first purchase or you are an experienced buyer, this decision must be made carefully

Why Do You Want To Buy?

Are you tired of paying rent? Have you decided to pay your own mortgage and not your landlord’s? Have you outgrown your current home? Are you looking for an investment portfolio? Are you looking for a rental property? Would you like a larger yard? Would you rather live in a different area? Do you want to shorten your commute? Having a clear sense of your reasons for buying will help you choose the right property.

Has Your Income Grown?

Property ownership is an excellent investment; whether you are looking for your dream home, a rental property, or to expand your investment portfolio. Owning real estate is one of the least risky ways to build equity or to obtain a greater return on your initial investment.

(6 p’s) (Prior- Proper -Planning- Prevents- Poor -Performance)

and 3 Questions to ask your BUYER before

Showing Properties

Before we start showing you properties as prospective clients you need to consider and we need to ask you (the buyer) some important questions that will result in a smooth process of closing at the end of the transaction. And we have one of the highest closing rates at 80% in the industry. Our goal is to hand you the keys and see your smile on your face.

All information is confidential and private. We do not sell your information to third parties. I’m originally trained as a Nurse and MSW and understand client rights. We assure you at Signature Homes Realty absolute confidentiality that is why we have clients and their children working with us generation after generation.

Questions 1: How do you plan on paying for new property?

Cash:

Buyer must show proof of funds (2 most recent month bank statements showing funds to close).

If you are a foreign national or here as a tourist let me know.

I love international buyers and sellers. I can help connect you with the legal process and connect you with professionals (banker, attorney & advocates)

Financing:

Has buyer been pre-approved by a mortgage lending institution?

Required documents for pre-approval are 2 forms of ID, last 2 years’ tax returns, 2 most recent bank statements and 2 most recent years W2s if wage earner…credit check.

Question 2: Are you working with any other Realtors?

If so, who? How has the experience been so far?

We strongly suggest working with only one Realtor so all of our attention is on you.

We actually have strong business relationships and often have properties come to us before they are listed.

If you are serious the buying mode we are serious to help you as well.

We also have buyer VIP programs.

Question 3: How quickly are you looking to close?

“If buyer is financing property make sure to advise him on preparing a complete 2-year history for residency and income/employment to speed up process.”

“If buying cash, make sure closing funds are in a U.S. bank account to avoid last minute delays.”

Banking institution advice

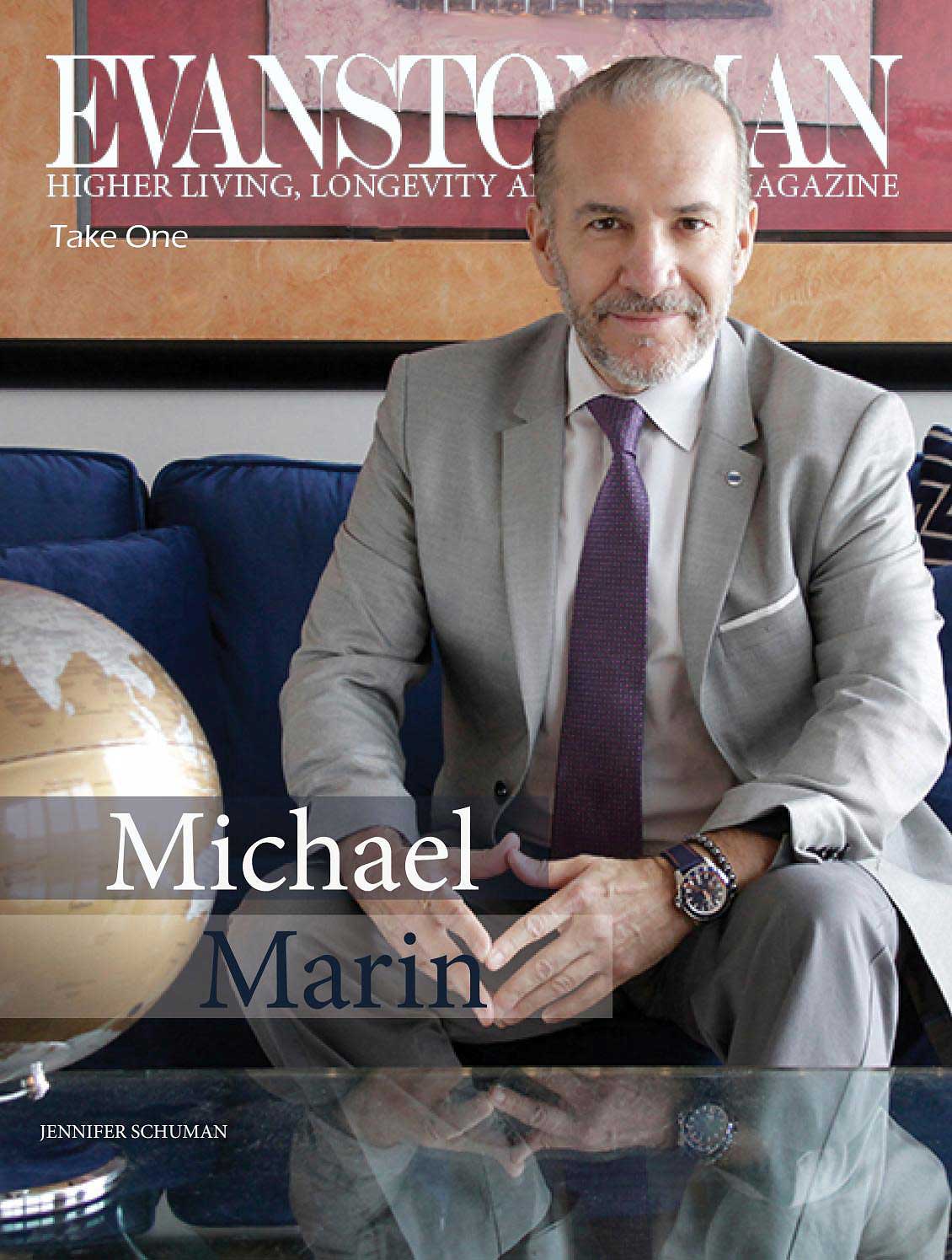

Michael Marin MA,MSW,RN

“Not… your average Realtor” (client’s opinion)

Signature Homes Realty, Inc is Licensed in Illinois and Florida for Real Estate Transactions.

Call today

(broker(at)michaelmarin(dotted)net (text or call 847-312-1014)